Logistics consultancy

October 2021 update on international transport routes and modalities to import and export from the Americas.

By your side importing and exporting

What is your biggest challenge when managing the logistics of your supply chain?

Ensuring that several shipments get to their destination on the right time?

Coordinating carriers between different routes and strategies? At Europartners Group, our teams are specialized not only in handling traditional transport modes, but in designing complete logistics solutions, based on your business’ most specific needs, combining alternatives of modes and routes in the most strategic way for your supply chain. We work to be more than a freight forwarder: we want to be your best strategic partner in

logistics, offering comprehensive solutions to manage all your shipments, enabling you to dedicate more time to grow your business. This month, you will find in this On top of logistics quality information about local market situation and our services available on the main global routes.

If you require personalized attention on a specific country, route or mode of transport, our teams are by your side 24-7/365. Contact us from Mexico at 800 888 EURO (3876) or contact us from anywhere in the world at: [email protected]

Insight from our experts on the global situation of logistics

The market is approaching what would normally be a peak season and, after a period of "disrupted" major ports around the world, port congestion is once again affecting the industry. Unlike the years previous to the Covid-19 pandemic, 2021 won't really have a high season in the traditional sense. Let’s take the ocean transatlantic service as an example. The market is already saturated, and carriers are largely unable to acquire the additional tonnage that would be needed to launch any actual service program in peak season. Importers and cargo owners anticipated this and tried to move shipments of typical high-season items to earlier slots, in an attempt to level the demand curve. This cargo contributed to the strong demand observed in the second quarter.

Regular lines markets continue to operate at utilization levels close to 100% for much of the year, high season or not. Therefore, supply chains are suffering serious operational problems with overload, accidents and setbacks that can get out of control and result in massive side effects. On October 5, we will host a live webinar to discuss whether supply chains are ready for such a disruptive world. Join us to get to know the perspective of Rocío Herrera, Lufthansa cargo sales representative, Alexander Katsouris,director of the automotive vertical of Europartners Group and Iván Cisneros, head of traffic of the Bocar group, and share your own vision with us. Click here to register (the webinar will be held in Spanish).

Air freight

The Ocean freight crisis regarding the lack of available spaces and containers, and constantly increasing rates must reach the first months of 2022.

We advise you to contact our teams to design alternative plans, coordinating well-thought air solutions, at least to ensure you have a safety stock and keep your supply chain running.

Asia

Although the Shanghai Airport continues to experience delays in operations and departures –in addition to flight cancellations from most airlines– due to new Covid-19 outbreaks and personnel restriction, we have service from Shanghai with full positions to Mexico.

In airports such as CAN, PEK, SZX, a lot of saturation and increased rates are reported, but CGO is absorbing a limited number of new freighter flights.

Airlines (CK, CA, CZ, AA, among others) with service to MEX via the US report heavy congestion in the connection at LAX. Connections may take several days.

Airlines in China keep increasing the air freight rate on a weekly basis (or every 3 days). We have frequencies in import and export cargo services between Japan and Mexico. Spaces between India and Mexico are saturated.

Aircraft are available for full charter operation from Asia to Mexico; however, we emphasize the importance of knowing the permit times, cargo details, weight and dimensions as soon as possible, in order to carry it on time. The demand for charter mainly large planes- begins to increase and availability to decrease, also, prices begin to rise.

Latin America

To get you the space you need to import and export between Brazil and Mexico, we have an allotment available every week. To export from Mexico to Colombia, we have two allotments available each week. Click here to learn more about the service.

This month, we are offering a weekly frequency in a cargo flight to/from Perú.

On-board courier (OBC) services are being reactivated in some countries, with specific permit conditions, such as following specific requirements from each country and their embassies, having health insurance with COVID-19 coverage and negative results in COVID-19 tests (usually PCR) and more. Nevertheless, Chile and Uruguay are not allowing foreigner to enter – even in transit. In charter mode, we can offer you excellent options for the Mexico-Latin America route (except to Venezuela).

Get to know more about our lanes from Mexico to the region clicking here. And click here to watch a bit of our service from Germany to Latin America!

North America

We’re covering all the main airports in the United States from or to Mexico. Nevertheless, it is very important to book in advance, as spaces are running out fast.

We are operating OBC services from/to the US regularly and with full coverage. This month, we expect air boarders with Canada shall be opened from September 21 on. Land borders are still opened for US citizens, and that’s the alternative we’re managing.

In charter mode, routes to the US and Canada continue to operate normally on GO-NOW services (small and medium airplanes).

Europe, Middle East and Africa (EMEA)

We keep handling:

• three weekly consolidations to import from Germany to Mexico in our own positions with different service levels

• a weekly consolidation in the route Italy-Mexico and

• a weekly consolidation in a direct flight from Spain to Mexico.

Please book your space as soon as possible. We also offer other air freight solutions with direct flights in import and export routes between Mexico and France (rates subject to space availability).

We can operate charter services to Europe according to permit times and equipment availability.

Capacity and rates are stable to ship cargo from Spain and the United Kingdom to USA and Canada. We usually can get spaces in 3 days.

From Turkey and United Emirates to US and Canada, we can usually find spaces in a week. OBC - Services from and to Europe were not 100% reestablished yet, but some countries are allowing couriers entrance under a few rules:

France, Germany and Spain: Accept OBCs that present a vaccine certification.

France: Requires a negative COVID-19 test with no more than two days.

United Kingdom: Mexico is in the red list of countries that can enter the region. Nevertheless, in our global network we have couriers with local passports that may enable our services. Click here to check everywhere we have a professional available and to watch an example of our service.

Let’s start with good news: Ningbo Meishan Island International Container Terminal (MSICT) has resumed operation of container gate-in & gate-out and vessel on August 25, after experiencing lockdown restrictions since Aug. 11. Although estimated waiting time is averaging 3-5 days and gates are expected to open for export containers only within 2-3 days of corresponding vessel’s ETA, the terminal is expected to be fully operational by today (Sep. 1 st).

Globally, congestion levels continue to cause ship delays and to increase operational instability. While transportation delays come primarily from suppliers in Asia, manufacturers in Europe and North America are the most affected by delivery delays. Consumer demand is expected to grow at an accelerated rate for the remainder of 2021, making it very possible that transportation delays will continue into 2022.

ASIA OVERVIEW

There are some spaces available for Shenzhen’s port, but shipping lines ask us to book with the largest possible anticipation. Shipping lines announced an Origin Congestion Surcharge (OCS) to cargo from Shenzhen to the United States and Canada, effective on Sept. 6.

Tianjin’s port is highly saturated. Shipping lines ask us to review case-by-case at least 2-3 weeks in advance. There are limited spaces available for Qingdao’s port. Spaces to Pacific Southwest, (PSW), Pacific Northwest (PNW) and US East Coast (USEC) are still critical and bookings may be only placed until the middle of September.

In the las week of August, shipping lines started to announce many ports omits, specially to Ningbo, Shanghai and Yantian ports, “in an effort to counteract delays in Far East Asia and Australia while still maintaining weekly coverage”. Keep in constant contact with your Europartners team.

ASIA TO LATIN AMERICA*

* Specially Mexico, but contact you Europartners’ team in our local offices from Guatemala to Argentina to get a plan tailored to your specific needs.

Rates have reached their highest levels in history, but the market is showing signs that it is reaching a breaking point, stabilizing at 5 digits (USD).

Some new port rotations and omissions determined by the alliances of shipping companies try to return the ships to the proforma.

Equipment imbalance remains a major problem.

LATIN AMERICA OVERVIEW

The situation in ports in Chile and Colombia remains complex. Approach your Europartners executive to get full visibility of your import and export cargo to these two countries.

ASIA TO UNITED STATES AND CANADA

Cambodia: Space full until week 40 (Oct. 3 to 9). All sailings have been overbooked, and we have a space shortfall of 350 TEU till today.

India: Space full after week 40.

Overall space to EC/WC & Gulf is very full. Major Carriers are not releasing space, even paying premium rates. We need at least 4-5 weeks to arrange booking in advance.

Indonesia: Space full until week 37 (Sep. 12 to 18). Most of carriers already stopped receiving bookings for POD USWC.

Malaysia: Space full until week 39 (Sep. 26 to Oct. 2). Currently in full lockdown due to a new Covid-19 spread. There is a lot of booking delay and cancellations. We need between 4 to 6 weeks to arrange booking in advance.

Philippines: Space full until week 39.

South Korea: Overall space to both USWC & USEC are exhausted till week 39, while booking window is not yet open for week 40.

All carriers’ equipment status is still tight at Busan. Port congestion has improved a little, but still has a delay of 7-8 days.

Thailand: Space full until week 39. Overall space to USEC/Gulf is very full, even paying premium. All carrier equipment is tight. Limit CY date is only 7 days before ETD. We are not allowed to pick up container in advance even we agree to pay a detention charge.

Vietnam: Space full until week 39.

HCM: The city is under a heavy lockdown and administered by the military since Aug 23.

HPH: The Hai Phong port is short of feeder service, so space is very limited.

TRANSATLANTIC TO USA AND CANADA

Germany: Booking window is 4 to 8 weeks out, depending on port pairings and carrier choice.

Italy: We need a pre advise of at least of three weeks to book to USA.

Spain: Market remains stable. There are no congestions and rates remain with no severe change.

Turkey: There is still a space and containers problem in Turkish ports. Prices are going high, and carriers are adding very high peak season charges.

UK: Ports are highly congested. Finding space can take between 2 to 5 weeks.

UNITED STATES AND CANADA OVERVIEW

Container ships are piling up again in front of the ports of Los Angeles and Long Beach. Shipping companies explain that part of the problem is the inability of rail carriers to remove containers from the terminal fast enough and deliver them to inland towns. Surcharges:

• Origin Congestion Surcharge (OCS) to cargo from Shenzhen to the United States and Canada, effective on Sept. 6.

• General Rate Increase (GRI) to all LCL service from the United States to South Africa, for cargo received at the originating terminal as of September 17.

• Inland Fuel Surcharge (IFS/EFS) to all import and export shipments with a US or Canada Store Door (SD) service as of Oct. 1.

• Rate increase to cargo moving in 20’ ft and 40’ ft equipment from the United States and Canada to Australia and New Zealand as of Oct. 1.

OCEAN EXPORTS FROM MEXICO

We’ll probably still experience space limitations until mid-September – for some destinations. Port congestion and port omissions vary according to the carrier but should continue. Market rates are also increasing with GRI announcements per container, affecting even longterm negotiations (named accounts). Shipping companies' services are oversold, so cargo priority is given to whoever pays the highest freight – with short-term rates.

This quarter (3Q2021), “free storage days” are being reduced.

Container fleet management is a major problem, as in some cases carriers prefer to ship empty containers on the Asia-Pacific - Latin America (ASPAAMLA) lane. It takes between 9 and 15 days to ensure availability in the port of Lazaro Cárdenas.

EUROPE TO MÉXICO

We expect more rates increase in September – but smaller ones. Regarding spaces, shipping lines are confirming departures for the end of the month. No don’t expect the availability of spaces and equipment to show great improvements at least until 4Q2021.

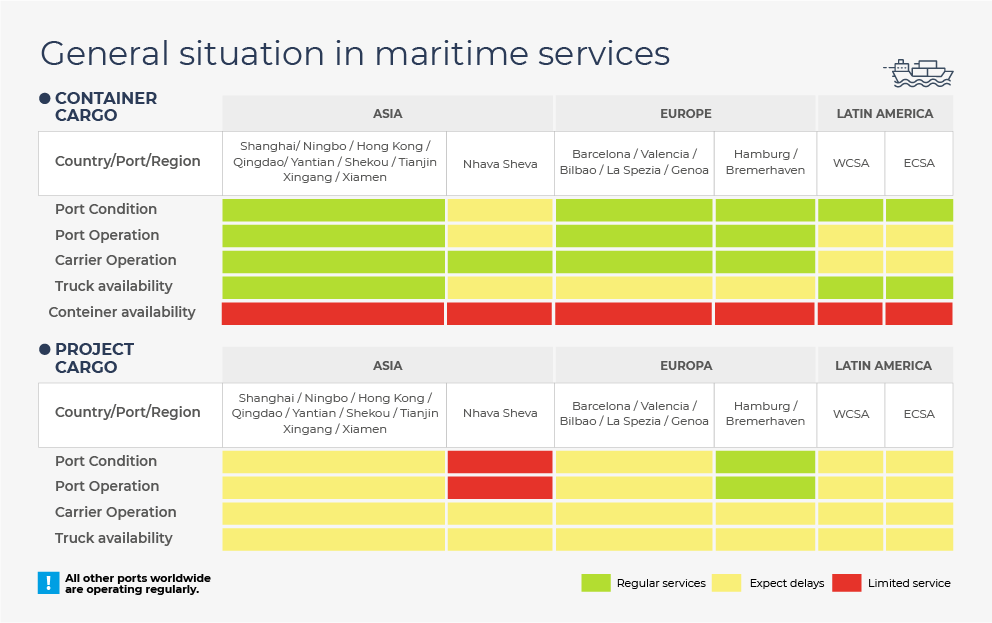

PROJECT CARGO

In Europartners Group, we think outside of the container! We work hard to be more than a freight forwarder: we’re your best strategic partner in logistics, supporting you to accomplish your production times and keeping your supply chain moving with transport plans tailor-made to your needs. We are experts in importing machinery and oversized cargo, especially from Europe.

Ground freight

Is ground freight a good option to transport your time critical cargo? Of course! Click here to learn all its strongest features in a glance. And, if you feel like you need a personal logistics consultancy, we’re here for you.

We need carriers! At Europartners Group, we are looking for international carriers with dry boxes and 48- and 53-foot platforms, from all regions of Mexico crossing Laredo from / to the United States-Canada and also from Ciudad Hidalgo to Central America.

Is this your business? Send us your cover letter and your contact details to [email protected] and [email protected]

Nevertheless, in a letter to U.S. Secretary of Commerce, the Owner-Operator Independent Drivers Association stated that “the Biden administration should reject the notion that there is a shortage of truck drivers and instead focus on why carriers find it difficult to keep drivers in their ranks”, as reported by Freight Waves. Do you agree with that?

North America

On Monday, September 6, the United States and Canada celebrate "Labor Day", so companies will close for the holiday.

The United States once again extended the closure of its land borders with Canada and Mexico for essential travelers until September 21.

Market - The "Team Driver" service is quite limited. The demand for expedited units in Mexico and US is growing, mainly to provide inputs for the restart of production, after scheduled shutdowns in automotive plants. In the three North American countries, we observed a decrease in the availability of units and changing costs according to the shipping zone. In the US and Canada, the market for small units is saturated - even with increases in the cost of freight, there is no significant growth in the supply of units.

Van to truckload ratio (FTL cargo waiting for a unit) have climbed USD 5.81 in August (they were an average of USD 5.56 in the US in July).

In Laredo (TX), now there are around 9 loads waiting for a truck. El Paso (TX) has now around 15 freights waiting to be loaded to a truck.

In the platforms market, we’re experiencing limited empty equipment capacity, but we have seen a decrease in the number of loads waiting for an unit: we reached 118 cargo ready for every available truck by May 2021 and 97 in June, but the average in August was 44 loads. Shippers are still dealing with one of the largest supply crises in history.

The volume of shipments continues to rise, due to:

• the restocking of inventories,

• the increase in online sales and

• the high demand for consumer goods.

1. The imbalance between imports vs. exports

2. The lack of additional capacity in the market

3. High perishables* seasons (fruits, vegetables and other refrigerated products)

Contact your Europartners executive if you need more advice on that type of movement.

If you need more information, quotes, reservations or a good logistics consultancy, contact us right now sending an email to: [email protected] or calling (from Mexico) to 800 888 EURO (3876). And if you want to quote, compare and even book by yourself, get to know our new online tool!